The stability of modern monetary systems depends on people’s trust on the governments and institutions that rule them.

Central banks impose the currencies used and arbitrarily control money supply and interest rates. Their negligent manipulation have caused inflation and hiperinflation crises all over the world, driving people to look for better ways of storing their capital to protect it from money debasement.

The search for a solution along with the advances in computer science and cryptography led to the creation of a decentralized virtual system that does not require to trust on a third party to exchange assets in a secure, transparent and reliable manner. This system is called Bitcoin.

History

With World War II coming to and end in 1944, 44 alied nations celebrated the Bretton Woods agreement that established the rules, institutions and procedures that would regulate the international monetary system after the war.

The countries agreed on fixing their currencies to the U.S. dollar, and to tie the U.S. dollar to gold at a price of $35 per ounce. The currencies were now (supposedly) indirectly backed by and exchangeable for gold.

A few years later, a series of conflicts known as the Cold War started between the United States, the Soviet Union and their respective allies. To face them, the United States began spending high amounts of money and in 1950 its balance of payments swung negative.

What’s worse, in 1964-1965 its president Lyndon Johnson launched the Great Society Program, a set of domestic programs to eliminate poverty, reduce crime, abolish inequality and improve the environment, which represented even more deficit.

As a consequence of all these spending, other countries became concern that the U.S. didn’t have enough gold reserves to back the money that was being printed and started exchanging their dollars for gold and demanding physical delivery.

Previously, the exchanges of currencies for gold were done within the banks of the U.S. to avoid the logistics of shipping the gold.

To prevent the outflow of gold, the American President Richard Nixon suspended “temporarily” the convertibility of the U.S. dollar to gold or other reserve assets in August 15, 1971. In March 1973 the fixed exchange rate system became a floating exchange rate system, giving birth to fiat currencies.

Fiat currencies are, by definition, backed by nothing other than government promises and people’s faith on them. They are measured only against each other and can be easily manipulated.

Fiat (decree) means “authoritative or arbitrary order”.

With the objective of offering an alternative to the traditional financial system, several entities tried implementing their own private currencies that were tied not to trust but to reserves of precious metals, like most nations used to do prior to the Bretton Woods agreement:

- E-gold: a digital currency backed with gold coins and operated by Gold & Silver Reserve Inc. (U.S.) that allowed users to transfer value from one account to another instantly inside their website.

- Liberty Reserve: similarly to e-gold, it was a digital currency that let users transfer money through a website with low transaction fees. Deposited funds where converted to Liberty Reserve Dollars that were tied to the U.S. dollar or to ounces of gold.

- Liberty dollar: a private currency that was issued in minted metal rounds (similar to coins), gold and silver certificates and electronic currency (eLD). Liberty Dollars were backed by gold, silver, platinum, or copper.

All three services were shut down by the United States government, charging their owners with federal crimes for money counterfeiting, laundering and conspiracy.

The U.S. government also prohibited the use of silver bullion, or any other metal coin or bar not issued under government authority, from being used as currency in commerce.

These projects provided a refuge against fiat currencies’ inflation and a simple and fast way of transferring value, however, their users were still required to trust a central authority and their reserves and services management.

Many researchers and computer scientists became aware that removing trust from the equation could only be achieved by a decentralized and distributed system.

In 1998, Wei Dai revealed B-Money, a distributed electronic cash system described by his author as “a scheme for a group of untraceable digital pseudonyms to pay each other with money and to enforce contracts amongst themselves without outside help”.

Wei’s proposal emphasizes in users’ participation to maintain a separate database containing all participants’ accounts balances, solve computational problems to create money, and validate, conclude and enforce contracts.

The idea of digital cash was originally introduced in a research paper called “Blind signatures for untraceable payments” wrote by David Chaum in 1983. However, David’s goal wasn’t a monetary reform but to give the individuals control over their own information.

This same year, Bit Gold showed up. It was proposed by Nick Szabo in an attempt to provide a solution to money counterfeiting, theft and its value depending on a trusted central authority.

The idea behind Bit Gold was an online automated currency with minimal dependence on trusted third parties and that could be securely stored, transferred, and assayed with similar minimal trust.

In 2005, Nick wrote a post were he mentioned interesting notions like proof of work securely timestamped, distributed property title registry and a chain of string bits.

Altough B-Money and Bit Gold were never implemented, many of their concepts were later used in the creation of the first and currently most popular digital currency.

On February, 2009 an individual/group under the name of Satoshi Nakamoto, whose identity is still unknown, posted that he has developed a new open source P2P (peer-to-peer1) e-cash system called Bitcoin.

Bitcoin replaces trust based models with a decentralized electronic payment system based on cryptographic proof.

Bitcoin

Bitcoin is a digital asset whose integrity is protected by cryptography2. It is decentralized, divisible and fungible.

In other words, it’s essentially bits of information that represent value inside a virtual system, which is designed to provide a secure, transparent and reliable infrastructure for their exchange.

Bitcoin offers a public way for two parties to exchange property titles with no trust on any third party.

They are easy to store and transport, and enable the possibility to transfer assets with no economic, geographical nor political limitations and without relying on states, banks or other central institutions for it.

The technology that powers Bitcoin and provides a way of achieving such challenges is known as blockchain.

Blockchain

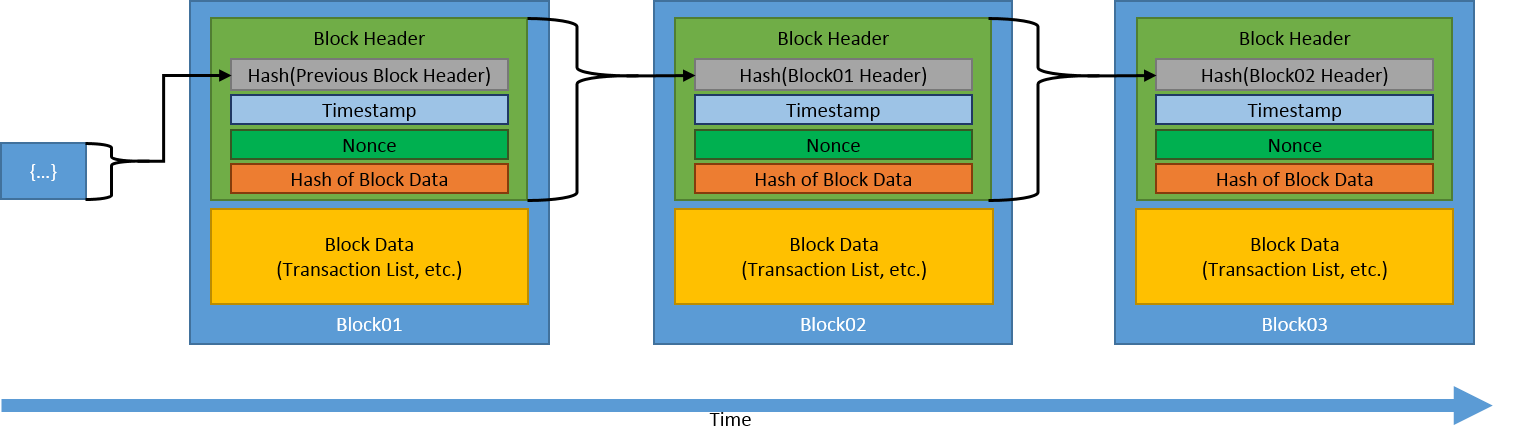

A blockchain is a distributed ledger (append-only database) managed by a decentralized network that stores information (typically transactions) grouped in blocks. Each block is linked to the previous one in the chain and contains:

- a hash3 of the current block’s content

- the hash of the previous block

- a nonce (number used only once)

- a timestamp

- other information (bits, weight, size, merkle root, number of transactions, difficulty, etc.).

These blocks are immutable, they cannot be modified once they are appended to the database.

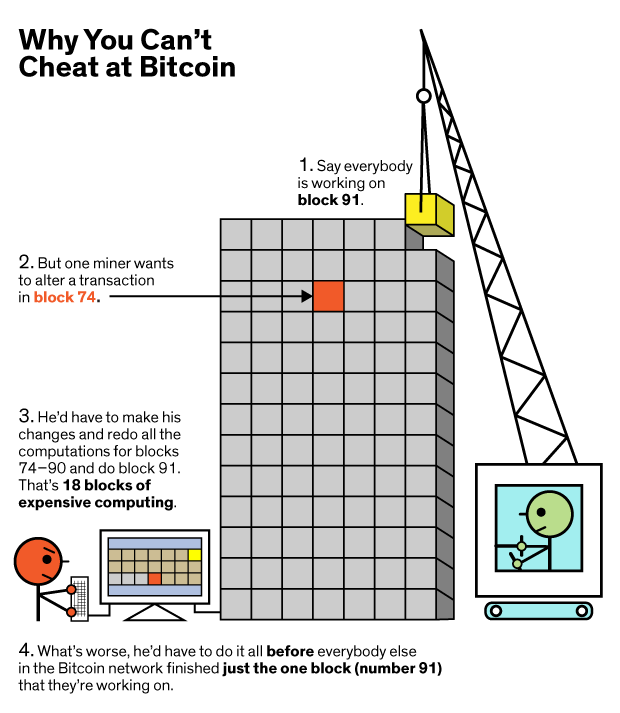

The only way to change some information is to replace the entire block and produce the largest chain, as we will see later, this is extremelly difficult and lacks incentives.

This immutability provides great transparency to the system, absolutely all the blocks and their information can be seen by anyone, anytime. Take a look at the first block of the Bitcoin blockchain here.

Blockchains storing transactions within a block organize them by using a merkle tree to verify their integrity.

For a block to take part of the blockchain, the full nodes on the network must agree that it contains legitimate information.

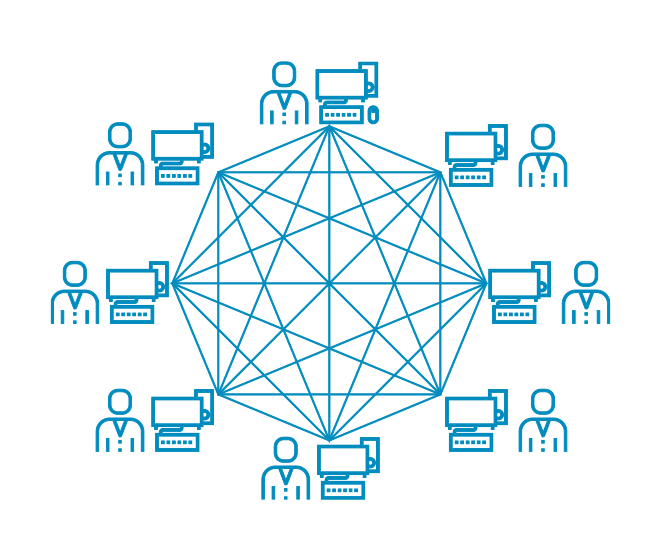

Each full node holds a copy of the entire database and validates that the transactions and blocks meet the blockchain’s consensus rules, communicating its decisions to the others in the network. It also updates the copy as new blocks are added.

Coordinating all the nodes is a complex problem in a distributed system and the reason why many consensus mechanisms were created.

Distributed systems and consensus mechanisms

A distributed system is a group of computers (also referred as nodes) operating independently and communicating between each other to exchange and agree on information to perform a task.

A blockchain network is one of them, it requires to be reliable, consistent and fault-tolerant but also needs a way of ensuring that the nodes spend scarce resources (electricity, time, etc.) in order to be elegible and participate in the system, otherwise any of them could attempt to inject malicious blocks without much endeavor.

There are multiple mechanisms to achieve this, the two most used in blockchain technologies are proof of work4 and proof of stake.

Proof of work

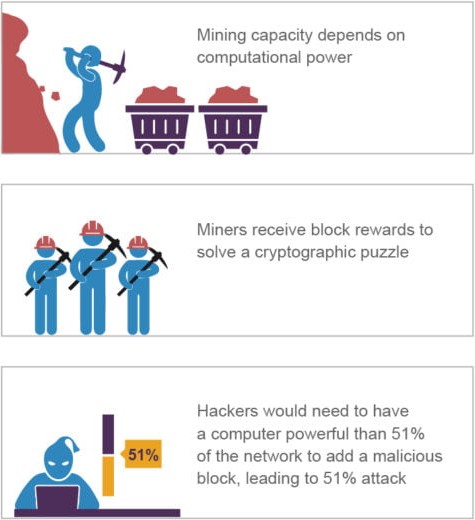

In a proof of work (PoW) system, blocks are added to the blockchain by miners, which are nodes that compete against each other to compute a hash that is lower than the target5. This calculation is computationally expensive.

To produce the hash, a miner takes the current block content, the previous block’s hash and a nonce (number used only once).

What miners try to brute-force is the nonce, they do the calculation over and over again changing its value to get different hashes and hopefully one that is correct.

The target difficulty is adjusted by reducing its value (hence reducing the probability of getting a valid hash) to keep block creation at a certain rate (1 per 10 minutes in the case of Bitcoin).

Once a miner finds (or thinks it has) the solution, it broadcasts the hash to the other nodes for them to verify if it is correct, this is done fast as the verification demands a single calculation.

In case the solution is valid, the miner is rewarded with a pre-established amount of coins that may or may not vary over time depending on how the system is configured.

In a blockchain using proof of work, its security relies on the difficulty of accumulating CPU power.

The network always trusts and replicates the longest valid chain, hence, corrupting it is only possible by mining faster than the rest of the network (having more than 50% of the network’s CPU power), this is, producing the longest branch of blocks and making the nodes discard the “honest” one.

This attack can change the current/future transactions but won’t affect previously stored ones. Modifying a past transaction is even harder:

Computational scalability

As the probability of guessing a right hash is directly proportional to the hashes per second the miner is able to perform, there is a race going on to make those hashes as fast as possible, which translates in high levels of electricity consumption.

This is one of the main criticisms to proof of work systems, considered by some as “extremely inefficient”. However, it’s clear that such an effort needs to be made to keep the blockchain secure and thus, protect the users’ property.

Cryptocurrencies using a proof of work system trade computational scalability for social scalability6.

Finance

Now that we know what a blockchain is and what it can be used for, let’s get an insight on Bitcoin price and how users store and exchange satoshis (Bitcoin’s smallest denomination).

Wallets

The users, in order to interact with the blockchain and make transactions, need a wallet. A wallet is an application that acts as an interface for the users to send and receive coins inside the blockchain. Each wallet has a public and private key which are used to sign and verify transactions.

The public key is used to identify a wallet, it could be thought as a unique address/username.

The private key is required to verify the ownership of the coins that are under the wallet with its public key pair. Losing it means losing access to all the coins.

Important: when you buy Bitcoin in an exchange, they are stored in a wallet owned by that exchange, it’s not safe to keep the coins there as they are the main target of cybercriminals, plus you don’t really own them. When you withdraw your funds is when they are sent to your wallet (the one protected by your private key and under your control). Not your keys, not your coins.

Wallets are tipically divided by their internet connectivity into two categories:

- Hot wallets: they are connected to the internet and suitable for daily transactions but not for long-term holding as they are more prone to attacks.

- Cold wallets: they offer higher security by handling the keys in an isolated and offline device (or a paper), ideally for holding.

The two most used types of wallets are hardware and software (desktop, mobile, web) but their differences won’t be covered in this post, I invite you to investigate yourself.

Transactions

Transactions are token transfers between two users within the blockchain and each one of them has a fee that is rewarded to the miner for calculating the hash of the block.

Users are in charge of choosing the amount they want to destinate to the fee, transactions offering a higher reward/byte ratio will be prioritized and those who offer a lower one are in risk of not being even considered by the miners. This means that transferring 1 coin costs almost the same as transferring 1.000.000 of them.

Double spending

One of the main concerns of past implementations of electronic payments was double-spending, which is solved in Bitcoin by recording and agreeing a single public history of the transactions in the order they were received, considering the earliest as the valid one.

Price

The price of Bitcoin, like any economic asset, fluctuates based on supply and demand.

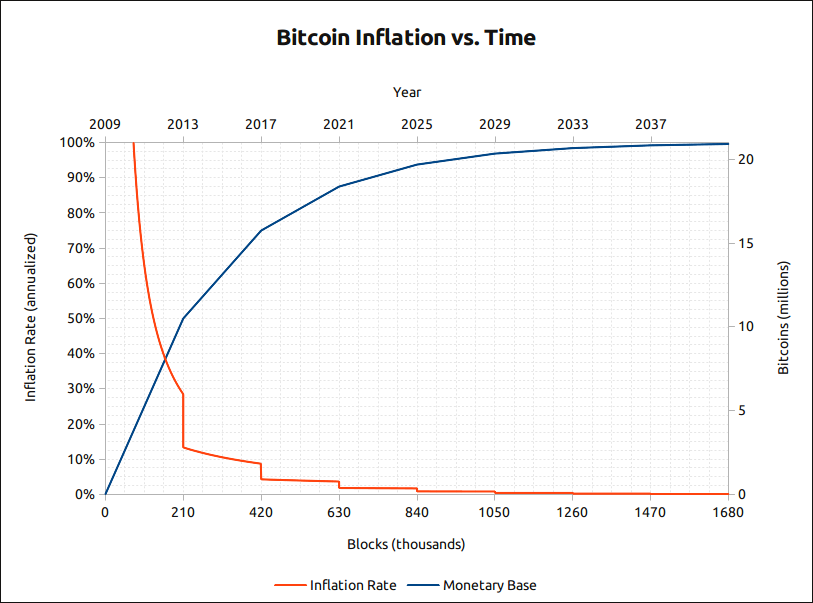

In Bitcoin, the supply is fixed to 21 million units, making it scarce and predictable by definition, as well as eliminating monetary inflation after the date set. This is why the term digital gold is often used.

In spite of this comparison, note that the amount of available gold is, even though barely increasing, still unknown and more could be found on earth or space.

Unlike fiat currencies, Bitcoin units are not created out of thin air, but require miners to spend scarce resources like time and electricity for it.

Furthemore, many of the coins fall out of circulation due to the owners losing access to their private key and thus to the coins, reducing the available supply even more.

I will be writing an article about money, if Bitcoin can be considered money and comparing it with fiat and commodity currencies.

Volatility

Bitcoin is well-known for being volatile, one of the core reasons for this is that it’s an emerging and immature market.

The introduction of a new technology that attempts to replace traditional institutions generates a lot of uncertainity and speculation, which derives in the variation of the consumers’ appreciation about the value of it.

If all the prices in the economy were removed, we would be in a similar situation where people would offer significantly different amounts of money for the same product.

We can expect the price to stabilize as Bitcoin adoption increases and more liquidity enters the market.

Fundamental principles

Decentralization

Bitcoin has opened up the possibility of exchanging assets in a secure and reliable way with no central authority being capable of controlling the transactions nor the system in which they are executed.

This is, decentralization eliminates the single point of failure of a system as there’s no authority whose decisions could impact its functionality.

At the same time, it makes the system virtually impossible to stop or shut down. Each node has a copy of the database and as long as they can communicate between each other it will keep working.

However, it’s not an intrinsic characteristic of cryptocurrencies, in fact, centralized ones controlled by a state, bank, company or institution exist.

Anonymity and pseudonymity

Blockchains were originally designed to be pseudonymous - they use hashes to identify users instead of personal information -, but when users interact with them anonymity becomes really tricky.

Centralized exchanges and applications that offer an interface to operate with the blockchain or companies that accept cryptos as a form of payment must verify the identity of their users, otherwise they wouldn’t be able to recognise who is sending/receiving currencies.

Depending on their location they could also be under Know-your-customer (KYC) and anti-money-laundering (AML) regulations, being required to provide sensitive information to the authorities in order to operate.

Decentralized exchanges, however, tend to be more private as they only operate with information inside the blockchain and under less regulations as they are not in control of the funds.

Futhermore, every single transaction remains in the immutable ledger forever. If your account’s public key is associated with your identity, absolutely all the transactions you have made in the past are now exposed, as well as the public key addresses of the parties that interacted with you - whose identities can be linked as well.

Transparency

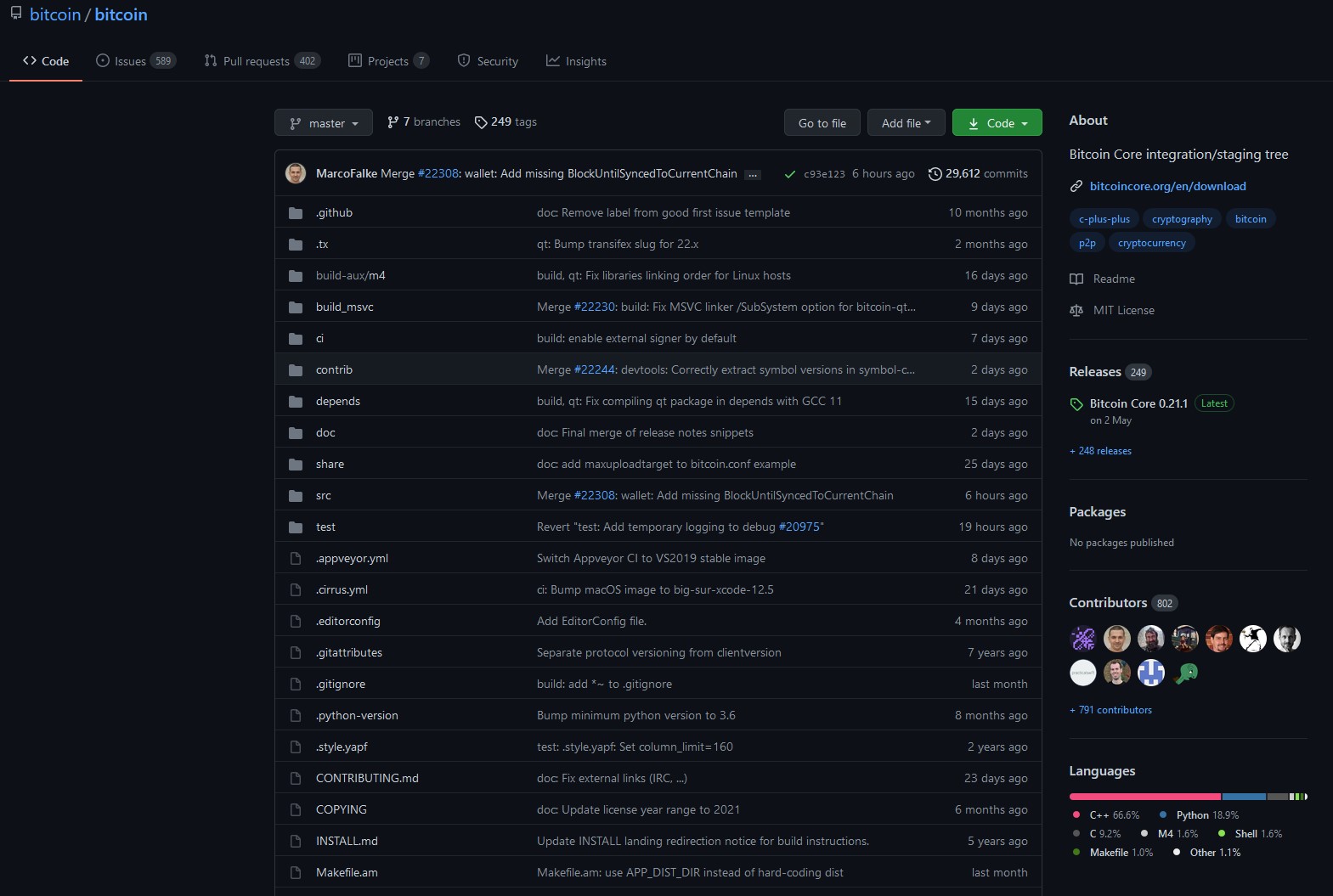

Instead of trusting a central authority, Bitcoin puts trust in code (cryptographic proofs), which in most cases is public and free to copy and modify.

It’s important to note that Bitcoin is not a single software project but a protocol that may be implemented by any number of clients which are in turn developed and maintained by a group of developers that have permissions to commit to the project.

In many cases, potential changes in the codebase are deeply discussed and reviewed by the community members before implemented, however, this might not be done in all of the projects. Bitcoin clients that do not comply with the consensus rules will have their transactions and blocks rejected by the other compliant clients.

When two groups differ radically in the scope of the project a hard fork can be produced, where one group stays with the current state and the other copies and modifies it to meet their needs. In these cases, the new version gives each of the nodes the same amount of coins that had in the old version.

Open-source means the code is open to the public and that anyone can read the codebase of the project and verify that what is being promoted is actually how it works.

I implemented a simplified version of Bitcoin which contains most of its core features and allows the user to run a simulated peer-to-peer network with several nodes communicating between them. The project is called btcs.

Conclusion

Cryptography, economics and computer science have been combined for the creation of a digital system that aims to improve the way in which multiple parties interact.

Agreements that previously required to trust an intermediary to supervise them now can be executed in a predictable way by a publicly accessible algorithm.

Bitcoin merely represents value and works as a medium of exchange inside those systems.

It’s uncertain if this project will be the one used to make daily transactions in the future, but they are clearly a big step towards the decentralization and digitalization of human’s communications.

Peer-to-peer refers to an operation done by members of the same network without relying on a dedicated central server. ↩︎

Cryptography is a process that ensures the confidentiality and integrity of some data by converting it in an unintelligible form. Its goal is the data to be readable and processable by only those for whom it is intended. ↩︎

A hash is a mathematical one-way function that converts an input of arbitrary length into an encrypted output of a fixed length. Using this function on the same data will return the same result, allowing users to verify the information integrity. One-way means it cannot be reverse-engineered, given an output we cannot discover the input. ↩︎

The proof of work mechanism was introduced by Adam Back in 1997 and originally used in Hashcash to limit email spam and denial-of-service attacks. ↩︎

The target hash is the maximum allowed value that a successful hash can be, it is determined by the difficulty. ↩︎

Nick Szabo’s definition: Social scalability is the ability of an institution – a relationship or shared endeavor, in which multiple people repeatedly participate, and featuring customs, rules, or other features which constrain or motivate participants’ behaviors - to overcome shortcomings in human minds and in the motivating or constraining aspects of said institution that limit who or how many can successfully participate. ↩︎